Crazy start to the week as Roaring Kitty made a social media appearance after a multi-year hiatus. Coinbase BTC/USD showed strong selling this evening, but this wasn’t witnessed across other exchange’s BTC/USD and BTC/USDT pairs. We have also seen numerous big banks and wealth management firms 13F filings noting that they’re holding Bitcoin ETFs.

Producer Price Index (PPI) numbers will be released at 8:30 a.m. EST on Tuesday morning. And the Consumer Price Index (CPI) numbers will be released at 8:30 a.m. EST on Wednesday morning. Expect volatility and knee-jerk reactions to these news events, especially the CPI.

Have you watched last Friday’s live stream with FiboSwanny?

Roaring Kitty

Meme stock king, Roaring Kitty, posted on Sunday, May 12th, for the first time since June 18, 2021.

And that single post sent GME and AMC stocks surging higher today.

GameStop (GME 0.00%↑) gapped up 118.79% from Friday’s close before pulling back a bit to close out the day.

While AMC Entertainment Holdings (AMC 0.00%↑) rallied 67.05% from the open to the day’s high.

Those reading this newsletter however will note that the charts were primed for both rallies, having been held back at descending resistance after being in a bear market decline since 2021. But are these stocks now headed back up to all-time-highs? It’s a bit early to tell, but I can make a case for both having bottomed. So, I would be patient and watch for a significant pullback after a bit more rally before entering rather than chase big candles. The goal should ALWAYS be to be positioned PRIOR TO the break out and rally, not to chase the big candles after they’ve already printed.

13F filings

We are seeing Bitcoin ETF holdings in more and more banks and wealth management firms as identified in their 13F filings. However, there is a caveat to these required notifications. The 13F only requires reporting of long positions, as well as ADRs, options puts and calls, and convertible notes. But it doesn’t account for short positions. And it doesn’t distinguish between who the holdings are for (the firm itself or the firm’s clients). So, be sure to keep that in mind when reading them as they could be part of a hedge against their Bitcoin shorts.

Do not anticipate and move without market confirmation - being a little late in your trade is your insurance that you are right or wrong.

— Jesse Livermore

The US Dollar (DXY)

Zooming into the daily chart this time around, we can note that the DXY is sitting below the daily pivot and the ascending channel EQ. It is range bound between the 104.522 support and 106.490 resistance. We want to see a breakdown below 104.522 to send the DXY through the ascending channel support as well. That will signal that the trend should continue lower and take out the swing low at the channel start.

Bitcoin All Time History Index (BTC/USD)

Bitcoin rallied a bit locally this weekend. Looking at the local range this time, we can note bearish market structure off the all-time-high punctuated by lower highs and lows. So what does this mean? We need to see a break out above the last lower high (LH) which is 64467.93 on this chart in order to signal that the bearish market structure has been broken. Along the way, I am watching for an impulsive breakout above the descending green resistance and daily pivot confluence area, as well as a break out above 65541.11 as early indicators that the bottom is likely in.

As quick note, we are seeing a lot of selling pressure only on the BTC/USD pair on Coinbase this evening. But that selling is immediately being soaked right back up leaving many long lower wicks at the 15m pivot. Should this continue to hold, it will be quite bullish for the pair.

HURRY UP AND GRAB A C3 MEMBERSHIP WHILE YOU STILL CAN!

I just opened up enrollment in the C3 membership yesterday. But it will only be open for 72 hours. That means it will close before the end of the day on Wednesday, May 15th. And once it’s closed it will be months before I open it back up again.

Included in the C3 membership is the same trading foundations, risk management, Elliott Wave Theory, and Wyckoff method courses that our group coaching students have access to, as well as the new price action course being released this month. In addition, you'll have access to the same community area that our group coaching students use (absolutely invaluable resource with helpful people and often many different charts to trade as well), daily updated charts for futures, forex, and crypto, Hot Takes (the best stock and crypto trade setups I come across throughout the month often leading to multi-100%s price rallies), and a monthly live training session (with access to previously recorded monthly sessions). This is the best way to access the TWC Trading Academy's educational content inexpensively to get a feel for what our group coaching program delivers if you're considering it and for those who are more of the DIY learner types.

Annual Access with discounted pricing

Solana (SOL/USDT)

Solana has printed one of the cleanest charts over the past year and a half. Currently, I’m looking for a rally from here to send price toward a minimum expected target of 301. Breaking out above 160 should send it on its way toward that target. That said, I believe we will also see 410 pretty easily before the end of the year.

TLT

The monthly TLT chart shows possibility for a bottom being in. We can note a strong, impulsive rally off the S1 pivot area, through wedge resistance, and into the pivot. The pullback off that pivot remains above the swing low. We want to see an impulsive break out above the pivot now which will give us some confidence that the low may be in. And doing so will give us a target of 118.70.

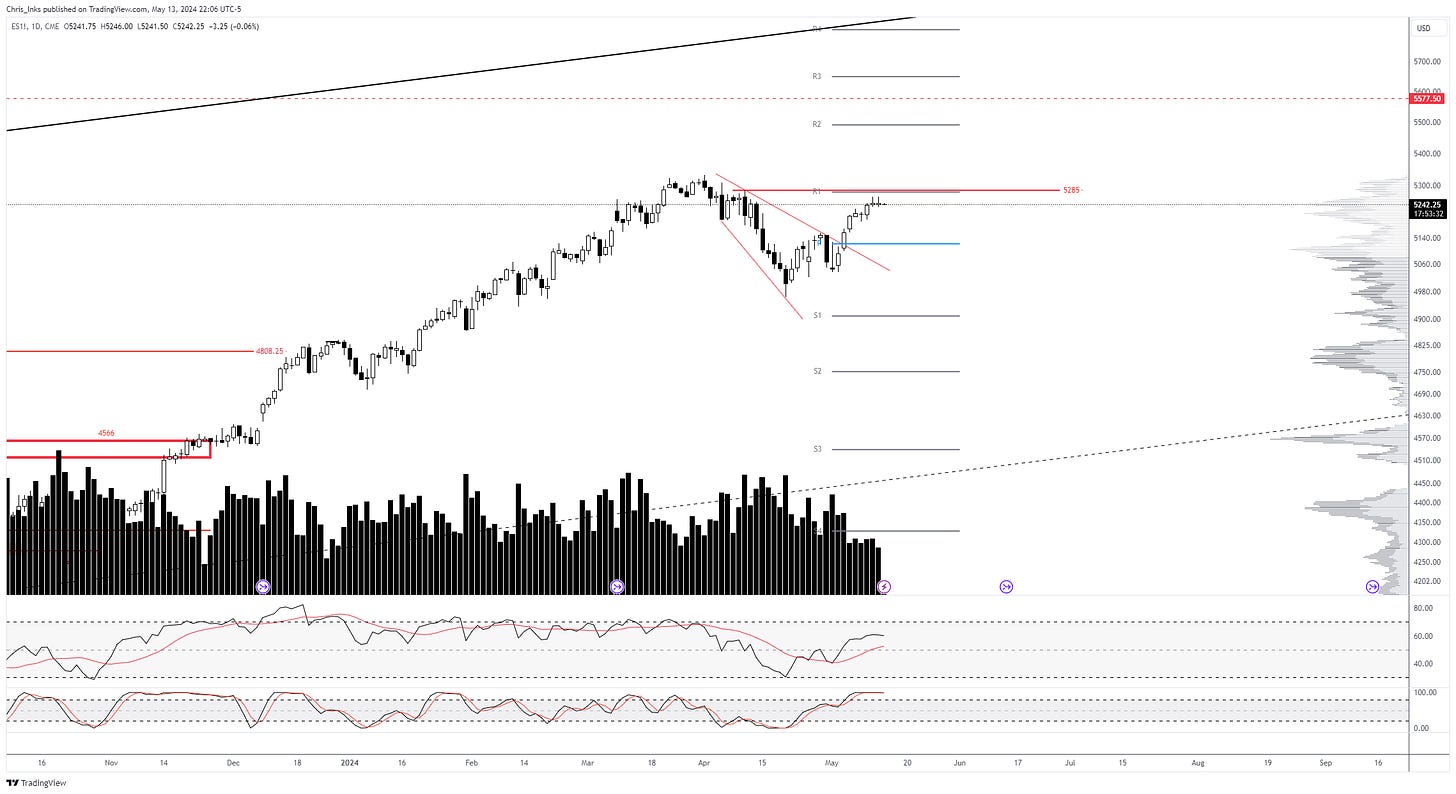

S&P E-Mini Futures (ES1!)

The S&P continued its rally toward the daily R1 pivot but has stopped short of the 5285 level. Breaking out above 5285 will give us an initial target of 5577.50. But a rejection here instead needs to see the daily pivot hold as support. Breaking down below it will suggest further downside that could target 4900 at least.

Join me as I co-host spaces with Gary Cardone every Tuesday at 5 p.m. CST/6 p.m. EST. And, also, as I join Scott Melker every Wednesday at 8:30 a.m. CST/9:30 a.m. EST with some of the more interesting charts of the day.

My Live Streaming Schedule

Simulcasting on Fridays

11:00 a.m CST

Interviewing guests and discussing charts: