Markets Are Sorting, Not Trending — Here’s What That Means

S&P grinds, Bitcoin consolidates, altcoins quietly unwind — and gold leads the truth trade

📊 THE MARKET BREAKDOWN

Weekly market intelligence for traders who think in systems, not headlines.

Issue #1 – April 16, 2025

🔎 This Week’s Focus

Flight to Safety and Capital Sorting

Gold breaks again to new all-time highs. Bitcoin holds structure. The dollar slips below key support. Altcoins quietly bleed out. SPY grinds but lacks leadership. Capital is flowing — but not into risk.

🧭 Top Charts of the Week

📈 SPY / QQQ / Risk-On Flows

SPY (S&P 500 ETF): $531.94

Pulled back ~2.1% from recent highs. Still above support, but momentum fading into earnings.

→ Above $540 = upside potential. Below $528 = confirms pullback. $520 = structural pivot.

QQQ: $426.17

Relative weakness continues. Semis softening. Leadership concentration persists.Risk-on flows: Narrow. Semiconductors and large-cap infra still working. Small caps stalling. No broad participation.

₿ Bitcoin & Crypto

BTC/USD: $84,433

Holding firm. Structure remains bullish above $81K.

→ $85.5K = breakout trigger. Below $81K = structure under threat.

Sovereignty Signal: BTC continues to behave like a macro hedge — not a tech trade. It’s tracking with gold, not QQQ.

ETH/USD: $1,578

Lagging BTC. ETH/BTC downtrend intact. Ecosystem capital is getting cautious.

🏅 Commodities / Gold / Silver / Oil

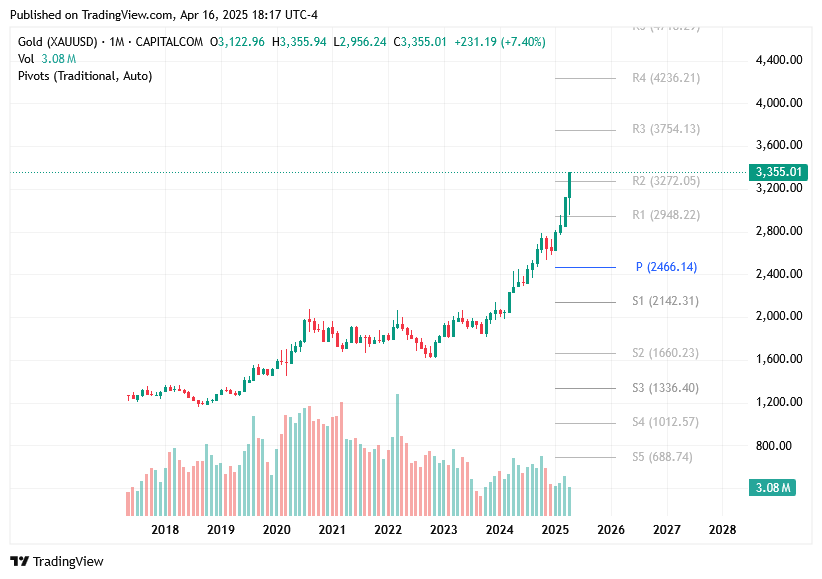

Gold: $3,358.40 (ATH)

Absolute strength. This is now a trust migration, not just a safe-haven bid. Gold is leading global capital repricing.Silver: $33.03

Outperforming alongside gold. Room to run if momentum sustains.WTI Crude: $61.99

Weak. Global growth fears outweigh supply concerns. Oil isn’t participating in the inflation hedge — gold is.

🧮 Rates / Bonds / Dollar

10Y Yield: 4.35%

Stable, but not dropping enough to drive risk-on flows.DXY: 99.42

Broke key support. Below 99.50 now opens the path to deeper USD weakness.

→ Watch 99.00 next — capital flight risk builds from here.

Liquidity signal: BTC and gold strong, SPY neutral, DXY breaking. Risk assets aren’t ready — but capital is clearly repositioning.

🔄 Altcoin Market Overview

🔢 Key Metrics

BTC Dominance: 62.73%

Rotational bid favors BTC — not alt beta.TOTAL3 (Alt Mkt Cap excl. BTC & ETH): ~$750B

Rangebound. No conviction.Altseason Index: 15/100

This is not an alt-friendly market.

📉 Sector Breakdown

AI (AGIX): $0.208 (↓ 3.8%)

Layer 1s:

SOL: $125.12 (↓ 4%)

DOT: $3.52 (↓ 3%)

ATOM: $4.00 (↓ 2%)Layer 2s:

ARB: $0.276 (↓ 4.3%)

OP: $0.630 (↓ 3.1%)Memecoins:

DOGE: $0.153 (↓ 2.3%)

WIF: $0.370 (↓ 7.9%)

PEPE: ↓ 7.3%RWA Narratives:

ONDO: $0.815 (↓ 4.9%)

NXRA: $0.0116 (↓ 2.8%)

🧠 Sentiment Snapshot

CoinCodex Sentiment Index: 70 (Neutral)

Fear & Greed Index: 38 (Fear)

→ Sentiment is cautious. No bid for alt beta. Capital remains defensive.

🧠 Concept Spotlight

Belief Drift & the Trust Trade

This week proves the rotation isn’t about yield or CPI.

It’s about trust. The market is telling us where capital wants to be when politics break, narratives fail, and systems creak. Gold and Bitcoin are rising not because of risk appetite — but because they are seen as uncensorable, ungoverned, and uncorrelated.

📖 Coming Soon: Forked Nations

What happens when the chain breaks before the system does?

A new Bitcoin fiction anthology from the creator of The Market Breakdown — exploring belief, collapse, digital sovereignty, and the fight for economic autonomy.

7 stories. 7 broken nations. One signal that never dies.

🧨 If you care about Bitcoin, capital control, or the future of free markets...

You’ll want to read this first.

👉 Click here to get notified when Forked Nations drops →

📌 Key Takeaways

Gold is in price discovery — and it's not done.

Bitcoin is behaving like macro collateral.

SPY is indecisive, drifting.

Altcoins have been fading without rotation.

The dollar’s breakdown may be a warning shot, not an invitation.

📅 Watchlist & Triggers

SPY > $540 → breakout continuation

SPY < $528 → pullback confirmed

BTC > $85.5K → upside extension

BTC < $81K → structure breaks

Gold > $3,360 → melt-up risk

DXY < 99.00 → global capital reallocation trigger

TOTAL3 < $725B → altcoin capitulation confirmed

NVDA, TSLA earnings → tech leadership test

💬 Final Thought

This market isn’t trending. It’s sorting.

Sorting trust. Sorting liquidity. Sorting relevance.

Don’t chase hype — track structure. Trade flow, not fantasy.

🔗 Stay Connected

Twitter: @txwestcapital

YouTube: Signal and Sovereignty

Thank you for the update👍🙏❤️

You're welcome! And thank you for reading, Sandi!