Bitcoin miners have access to a lot of power. What needs power in exponentially-increasing amounts? Artificial Intelligence and hyperscalers. Also, we will take a look at last week’s Bitcoin ETF inflows, the new Texas stock exchange, and of course some charts.

Be sure to watch the latest episode of my Friday Market Breakdown…

…and my new weekly podcast Beards and Bitcoin airing on Wednesdays at 11 a.m. CST as Andrew and Tillman join me each week to discuss Bitcoin price, news, miners, and institutional insights.

Bitcoin Miners

The Bitcoin miner trade is something I have been vocal about for the past 1.5 years. CleanSpark ($CLSK), for instance, has risen 12x since January of 2023. The weekly chart currently looks strong as the stock is nearing completion of over 1540 days of accumulation.

If you have missed out so far, don’t fret as there is still much more upside to come. After such a long accumulation period, we should expect a strong and large break out next. We can see local sideways price action sitting on the range resistance for the past ~4 months as the weekly Stoch RSI has reset into oversold and RSI finds support on neutral. I expect CleanSpark to surpass $100.

But that isn’t the only one making waves. Check out TeraWulf Inc. ($WULF) which is breaking out of a local re-accumulation range. I have a $9.90 mid-term target.

Another example is Riot Platforms Inc. ($RIOT) which appears to have completed its local pullback within the larger re-accumulation range. Breaking out impulsively above the descending red resistance should see it taking out the weekly pivot, and that leads to a local target of $23.35.

Want more? You’ve got it!

I am launching a brand new newsletter called the Bitcoin Miner Stocks Report.

The first 500 subscribers will receive forever access at the Founder’s special one-time price of $50. This access will include weekly updates of all 18+ Bitcoin miner charts as well as in-depth analysis of industry news and monthly interviews with analysts and others in the industry that you will only find there.

It’s like having your own personal analyst helping you understand the industry and how to make money investing in the companies that make it what it is.

If you didn’t get into $CLSK, $RIOT, $MARA, and other mining stocks at the lows when I started mentioning that they were good buys then you don’t want to miss out on this now! But be quick because, as I mentioned, the one-time $50 Founder price is only available for the first 500 subscribers. The first issue will be released, Monday, June 17th, and then following issues will be released every Monday after that.

*If you are one of the few TWC lifetime members this subscription is included in your membership, so send me a quick DM to make sure I get you subscribed.

So, how do A.I. and hyperscalers fit into the Bitcoin miners play?

The Bitcoin halving slashed rewards for Bitcoin miners once again in April. This forces consolidation in the industry as weaker players either go into bankruptcy, out of business, or are gobbled up by stronger players due to the low-margins associated with mining. We are already seeing consolidation possibilities with Riot’s attempted hostile takeover of Bitframs ($BITF) within the last few weeks, as well as CoreWeave’s unsolicited $1B takeover offer for Core Scientific ($CORZ).

Core Scientific which only recently emerged from bankruptcy at the beginning of the year announced last week that they have signed a 12-year contract with CoreWeave to deliver ~200 megawatts of infrastructure. This was days before the aforementioned unsolicited takeover offer. They have been diversifying since 2019.

Other notable miners diversifying into A.I. include Bit Deer ($BTDR), Bit Digital ($BTBT), Hut 8 ($HUT), Hive ($HIVE), Iris Energy ($IREN). While the draw of the diversification is the greater profit margins and less volatile revenue stream the companies each have different approaches to try and make it work.

JPMorgan recently released a report stating that the access to large amounts of power that U.S. Bitcoin miners have makes them potential M&A targets, per CoinDesk. Potential aggressors noted include hyperscalers and AI firms.

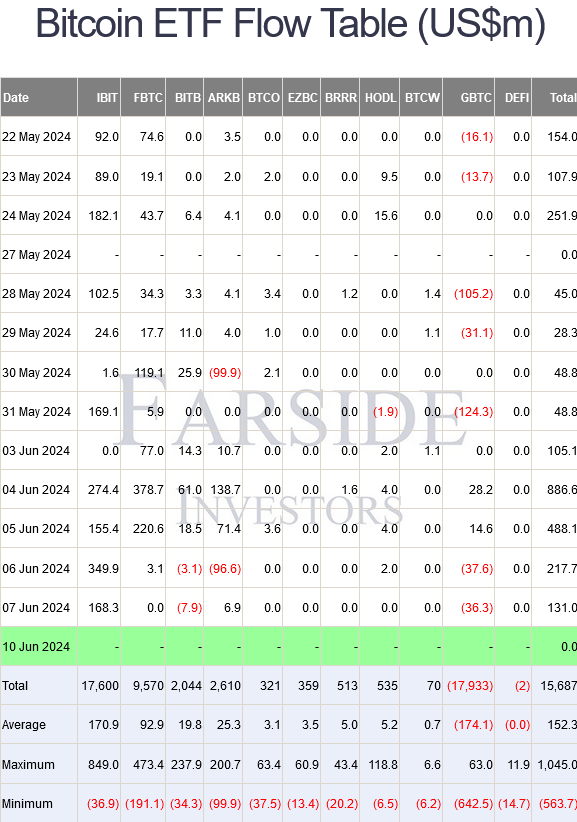

Bitcoin ETF inflows

Unless you’ve been living under a rock, you’ve likely heard that the Bitcoin ETFs has their second largest inflow day on Tuesday, June 4th, pulling in $886.6M. They pulled in another $488.1M the next day. The week saw total net positive inflows of $1.828.5B.

This has caused confusion amongst many novice retail traders who are now claiming that the ETFs don’t actually hold Bitcoin since price did not break out into new ATHs after such a large haul. The truth is that price discovery is a combination of the ETFs, spot price, futures, perpetual futures, and options. None of those dictate Bitcoin’s price by itself.

In fact, we can also note that long term holders (blue area) have been selling off since the end of last December as shown in the chart below. But there’s nothing to be concerned about here as we usually see this happen as price nears its ATH every cycle. What is more important is that the ETF buying has actually buoyed price so we haven’t seen the usual more significant drop in price that we have in the past.

The new Texas Stock Exchange

In case you haven’t heard, the Lone Star State may soon be welcoming a new stock exchange based in Dallas.

The TXSE’s draw would be that it faces less regulation than New York, making it easier to invest in U.S. stock markets, and it has access to more than 5,200 private businesses in the region that founder and CEO James Lee views as potential IPO targets.

The TXSE Group includes BlackRock, Citadel Securities, and almost 50 other investors, and has raised $120M. They are currently in the process of registering with the Securities and Exchange Commission (SEC). The goal is to begin operations as a national securities exchange later this year and compete with the NYSE and Nasdaq. They accounted for more than 20% and 15% of the equities trading volume, respectively, in May.

TWC Trading Academy Group Coaching

Tired of not knowing what you’re doing in the markets? Do you want to finally understand how and why markets move like they do? Not only that, but what if you could also learn how to trade them profitably? We teach day trading for income and price forecasting for wealth building in the markets. Join the TWC Trading Academy today and stop throwing away money! See for yourself what people think of Christopher Inks and the TWC Trading Academy.

What’s new in the Academy this month? I have just released an ICT QuickStart price action trading course based on the most important ICT concepts and how to use them together to create winning trade setups. These concepts are usable on all time frames, but may be especially valuable to those traders who want to scalp the low time frames. They will also help you find much better entries when utilizing Elliott Wave Theory or the Wyckoff Method which you will also learn.

I will also be adding more in-depth explanations of deeper concepts and understandings within the ICT methodology as the weeks and months go on for those who are interested in understanding it better. However, these will not be required in order to take full advantage of the quickstart course.

Finally, I am also going to be adding live trading utilizing what you will be learning in the ICT QuickStart price action course to your group coaching access which means you will finally be able to day trade and/or scalp live with me. The live trading has a tentative launch date of July 2024. But I will launch it in June if it is at all possible.

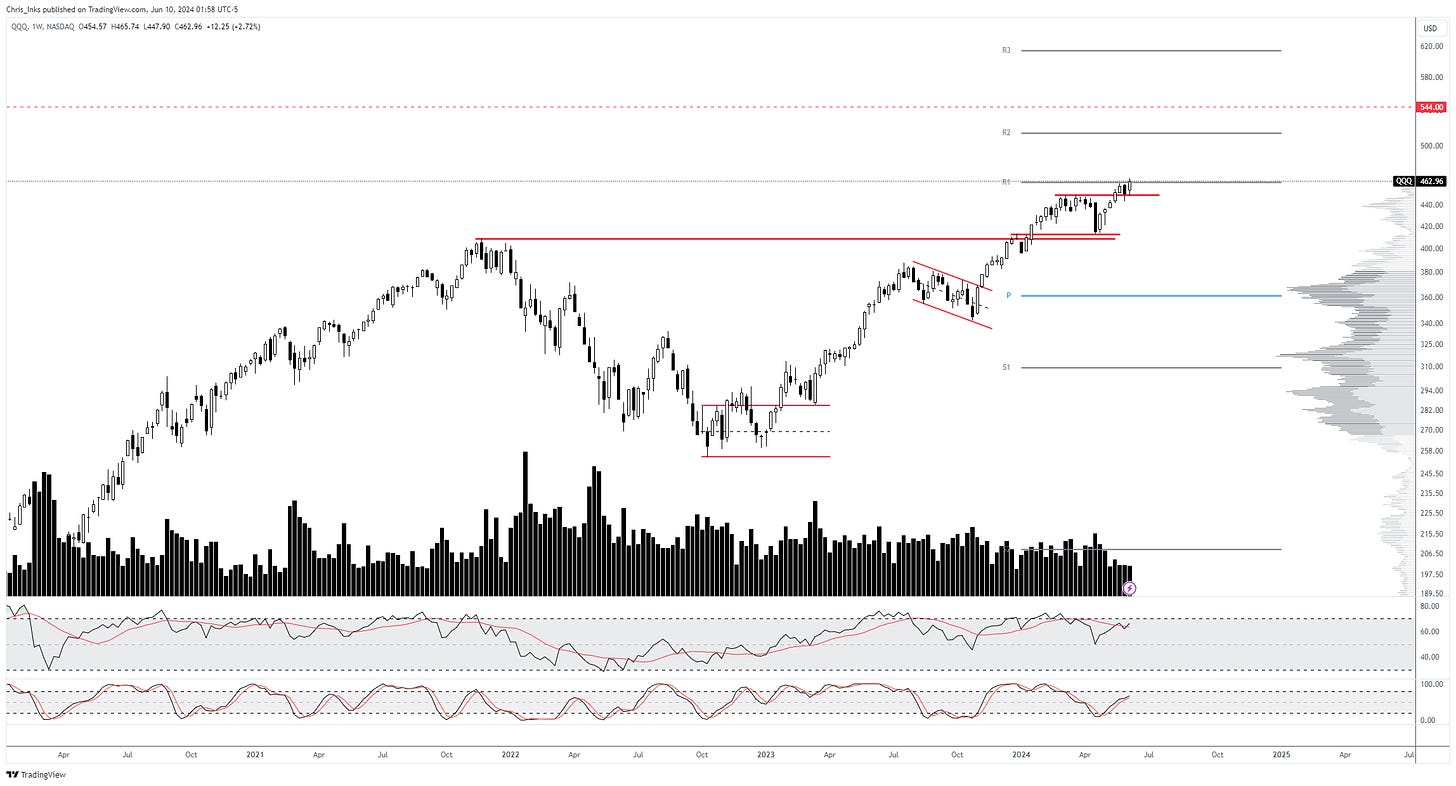

Invesco QQQ Trust (QQQ)

The QQQ continues to look strong on the weekly time frame. We can note a local breakout and retest before breaking out higher once more last week. That has pushed it into the R1 pivot. The Stoch RSI and RSI, both, are nearing overbought signalling strong bullish momentum. The current target sits at 544.

The US Dollar Index (DXY)

The DXY caught a bid on Friday after the non-farms payroll report (NFP) was released. The report showed a stronger than expected jobs number with 272K thousand jobs created while unemployment moved a tick higher from 3.9% to 4.0% (the first time it’s been 4.0 or higher in two years) and average hourly earnings rose to 4.1%.

This rally in the DXY has carried it into the yellow range I had previously noted as where I am looking for a rejection. But a breakout above the range will have me watching the secondary target of the weekly R1 pivot at ~105.934.

Bitcoin All Time History Index (BTC/USD)

Price did break out above the descending purple resistance, rallying into $72660 before pulling back to test the resistance as support. As long as the daily pivot at ~$65800 holds as support we can expect a likely breakout into new ATHs sooner rather than later. It is possible that a flat correction in printing in the local red range area and that would see a dip below it into the daily pivot to print a spring before rallying and breaking out higher. The daily Stoch RSI is nearing a reset into oversold while RSI remains bullish above neutral at this time.

Markets are never wrong — opinions often are.

— Jesse Livermore

S&P 500 E-Mini Index Futures (ES1!)

The index broke out above 5339 which adds confidence to the 5470 target area. If the current pullback closes below 5329, then that gives us a likely target of 5273.50. And that is where I will be looking for a reversal.

LTO Network (LTO/USDT)

The pullback looks like it may be complete at the S1 pivot. Stoch RSI bottomed out in oversold, has crossed bullishly, and is threatening to break out. RSI turned up just prior to hitting oversold and is nearing a bullish cross. But we need to see an impulsive breakout and close above the descending red resistance to signal that the pullback is likely complete. That will give us an initial target of 0.3656 followed by a secondary target of 0.4785.

Join me as I co-host spaces with Gary Cardone and Samuel Armes every Monday at 4 p.m. CST/5 p.m. EST. And, also, as I join Scott Melker every Wednesday at 8:30 a.m. CST/9:30 a.m. EST with some of the more interesting charts of the day.

My Schedule

Beards and Bitcoin simulcasting on Wednesdays

11:00 a.m CST

Market Analysis simulcasting on Fridays

11:00 a.m CST

DISCLAIMER: This newsletter is intended solely for educational purposes and should not be construed as financial advice. It does not constitute an investment recommendation or a solicitation to buy or sell any assets. Please exercise due diligence and conduct your own research before making any financial decisions.

The Market Breakdown newsletter does not operate as a registered investment advisor. This document is provided purely for informational purposes and does not constitute an offer or invitation to buy or sell any financial instruments. The viewpoints expressed are derived from historical data analysis and are deemed reliable, though their accuracy is not assured. Readers are entirely accountable for any decisions made based on this information.

CFTC RULE 4.41 - These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.