The newsletter was inadvertently not scheduled last week due to the long Memorial Day Holiday weekend. Sorry about that. For the last few years I have been talking about the likelihood that the Dow Jones Industrial Average targets at least 50000 and the local Elliott Wave count does appear to take it near there. Trump was found guilty of 34 Class E felony charges in New York. Additionally, as of May 28th settlement dates in legacy markets are now T+1; no more T+2. Finally, new additions are being added to the TWC Trading Academy. Plus I have charts to discuss. Keep on reading.

FiboSwanny was my guest this past week and we took a look at how the Dow gets to 50000, as well as the gold, SPY, Bitcoin, Ethereum, the Russell 2000 small cap index charts, and more!

And, if you haven’t yet, be sure to check out my new weekly podcast Beards and Bitcoin airing on Wednesdays at 11 a.m. CST. Andrew and Tillman join me each week as we discuss Bitcoin price, news, miners, and institutional insights.

The Dow to 50,000

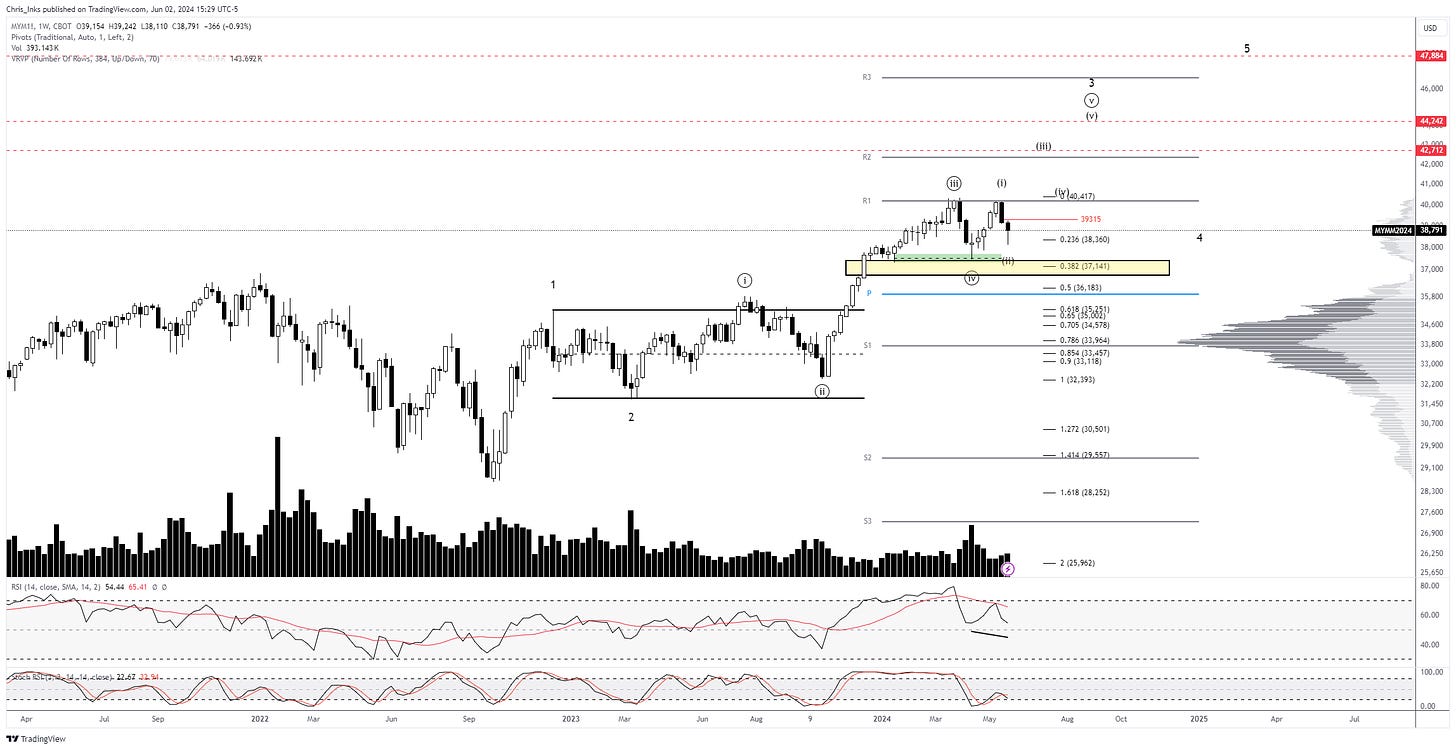

For the last few years I have been stating that the most likely outcome was that the Dow would be headed toward 50,000 and the local Elliott Wave count appears to agree. Looking at the weekly Dow Futures chart (MYM1!) we can see that the current pullback is likely wave (ii) of 3 after pulling back 78.6%. We need to see a break out above 39315 to add confidence to this count. That will give us a minimum expected larger degree wave 3 target of 44242 and wave 5 target of 47884. If we get a breakdown below the 38110 swing low instead of above 39315, it will suggest a likely continuation into the current wave ((iv)) swing low at 37462. And breaking down below that level will signal that wave ((iv)) is still in progress and printing a flat correction with an initial target of the 38.2% retracement level at 37141 or secondary target of the 50% level of 36183 just above the weekly pivot.

“But, Chris, I thought you said it was going to 50,000?” And I do believe it is. These targets are based on minimum expected wave (iii), (iv), 4, and 5 targets. They often overextend which will give us a higher overall wave 5 target. Additionally, because 50,000 is such a psychological number, reaching almost 48,000 should leave little reason for the index not to push just a bit higher toward 50,000. Finally, IF this is a grand super cycle third wave top that we are working on, then we should expect a blow off top rather than just minimum expected targets and that should send the index over 50,000. Grand Super Cycle wave psychology is euphoric with more and more of market participants entering and sending it higher, well-above minimum expected targets.

Trump guilty on 34 felony counts

Trump has been found guilty on 34 felony counts in his hush money trial. Sentencing is scheduled for July 11th which is just four days before Republicans are expected to pick him as their 2024 nominee. Following the guilty verdict, Trump’s fundraising page crashed due to 82000 people contributing donations in a very short period of time. It was back up 30 minutes later. A day later the Trump campaign released a statement announced that $34.8M had been raised after the verdict. As of today, they have received over $200M since the guilty verdict.

With the sentencing not until next month, the Trump v. Biden debate is still set to run. But can he still become president? Yes. Imprisonment does not bar him from continuing his presidential run. There are only three requirements in the US Constitution for presidential candidates:

Natural born citizen

At least 35 years old

Has been a US citizen for at least 14 years

At this point, the prosecution hasn’t mentioned if they are seeking imprisonment, and even if they do the judge is not required to sentence him to as such. As a matter of fact, in similar cases only 1 out of 10 defendants have been sent to prison. And usually those who are also have other charges connected to the case. Furthermore, Trump’s age (77) and him being a first time offender weigh in his favor. That said, the judge has donated to democrats in the past and had threatened to throw Trump in jail for violating a gag order earlier in the trial.

Interestingly, by law former presidents receive lifetime around-the-clock Secret Service protection, so how does this play out if Trump goes to prison? Anthony Guglielmi, chief of communications for the Secret Service, stated “Today’s outcome has no bearing on the manner in which the United States Secret Service carries out its protective mission. Our security measures will proceed unchanged.”

With that in mind, the DISGRACED Former Protectees Act (H.R.8081) was introduced and has been referred to the House Committee on the Judiciary. This proposed bill would automatically terminate Secret Service protection for those sentenced to prison after being convicted of a state or federal felony and clarifies that prison authorities would assume responsibility for the protection of all inmates regardless of previous Secret Service protection. In other words, Trump would not have Secret Service protection in prison if he is sentenced to prison and this bill passes while he is there.

But this bill is nowhere near passed yet, and may not even see a vote at all, therefore the judge is going to have to weigh the Secret Service protection factor in his sentencing. As it stands, I think the judge will receive a lot of push back from the prisons and the Secret Service about sending Trump to prison, noting the significant logistical difficulties that they will incur. So, we can probably add this point in Trump’s favor as well. As mentioned previously, most Class E convictions (the lowest class of felonies in the state of New York) usually result in some combination of fines and probation rather than prison.

Trump Media and Technology Group Corp. (DJT) does appear to be bullish overall on the daily chart. Breaking out above the wave (b) extreme at 79.38 will add confidence to the count. That will give us a minimum expected wave ((iii)) target of 285 and wave ((v)) target of 517.25.

Settlements are no longer T+2

May 28th marked the shift from T+2 to T+1 settlement cycles for bonds, ETFs, MLPs, municipal securities, mutual funds, REITs, and stocks that are traded on U.S. exchanges. This means any of the Bitcoin ETFs that were settling on T+2 are now settling on T+1.

What is T+1? This refers to the time in which the ETF has to settle any transactions. Whereas it used to be the trade date plus a choice of 1 or 2 business days, the requirement for the aforementioned products are trade date plus 1 business day now. They no longer have a choice. So, if you purchased or sold shares of any Bitcoin ETF, for example, on Friday, May 31st, it must be settled before Tuesday, June 4th.

Most market participants won’t really notice any change in their day-to-day trading/investing unless they’re using margin accounts and are used to putting off an extra day before ensuring their money market fund proceeds are available. If that’s you, then make sure you’re paying attention.

TWC Trading Academy Group Coaching

If you haven’t signed up yet, you’re almost out of time to use coupon code: MD2024 for 35% off our group coaching 3 month, 6 month, or 12 month access initially and for as long as you renew regardless of how much the price goes up!

And FOR THE NEXT 48 HOURS ONLY, we are providing a payment plan option for our 12 month access. Use coupon code: MD2024

What’s new in the Academy this month? I will be releasing a ICT QuickStart price action trading course some time tomorrow based on the most important ICT concepts and how to use them together to create winning trade setups. These concepts are usable on all time frames, but may be especially valuable to those traders who want to scalp the low time frames. They will also help you find much better entries when utilizing Elliott Wave Theory or the Wyckoff Method.

I will also be adding more in-depth explanations of deeper concepts and understandings within the ICT methodology as the weeks and months go on for those who are interested in understanding it better. However, these will not be required in order to take full advantage of the quickstart course.

Finally, I am also going to be adding live trading utilizing what you will be learning in the ICT QuickStart price action course to your group coaching access which means you will finally be able to day trade and/or scalp live with me. The live trading has a tenative launch date of July 2024. But I will launch it in June if it is at all possible.

Coinbase Global, INC. (COIN)

Coinbase continues to look good overall. We can see a nice impulsive rally off the pivot area into the R2 pivot before pulling back. Price has pulled back in a clean descending channel into the weekly faif value gap (FVG) denoted by the yellow range. It recently rallied into that channel’s resistance which was followed by a pullback to the channel’s EQ. Breaking out impulsively above the descending channel resistance will set up an expected target of 357.30 which will put it near the ATH.

The US Dollar Index (DXY)

After rallying back up into the supply cluster denoted by the yellow range, the DXY was rejected and has wicked down below 104.522 and the ascending channel support once more. We are still looking for an impulsive breakdown and close below the channel support to signal that further downside is coming. Until then, while the DXY remains below 106.49, and especially the yellow range, my bias remains to the downside.

Bitcoin All Time History Index (BTC/USD)

After the impulsive rally up into the ~71,500 area I said that usually we will expect a pullback from around that area and that the pullback is likely to head toward the 64,192-65541 range. And from there is where we look for the rally that breaks through the resistance at the all time high. The pullback has, so far, stopped at 66317.75, just shy of the target area. We could still get a push down into that target range. But an impulsive break out and close above the purple descending resistance will signal that the pullback is likely complete. Once that happens, I will be watching for an impulsive rally and break out above the ATH.

I still believe we will see a short squeeze that carries price into the low-$80Ks at least when price does break out. We can note that open interest has continued to rise with hedge funds adding to their shorts in a much larger degree than their longs and asset managers doing the opposite. So the record level of shorts continues to grow

.

The human side of every person is the greatest enemy of the average investor or speculator.

— Jesse Livermore

S&P 500 E-Mini Index Futures (ES1!)

After sweeping the May 14th sweep low we saw a late afternoon surge higher on big volume Friday which appears to signal that the index has likely completed its pullback. Breaking out above 5339 will add confidence to this scenario. That gives us an expected target of 5470 as the next stop on this overall upward trajectory.

Russell 2000 E-Mini Index Futures (RTY1!)

I mentioned that the RTY1! was a buy at the end of October 2023 as it appeared to be printing an accumulation range and that dip just below range support was the spring. It has rallied 31% since then. Currently, it is nearing completion of another range (the BUEC or Back Up to the Edge of the Creek) as a wave (iv) triangle. Breaking out above the wave d extreme at 2132.50 will indicate that the triangle is likely complete and wave (v) of ((i)) is in progress toward an expected target of 2339. Until the break out above wave d it is possible we can see wave e pulling back further into the range EQ at ~2000.

DogeCoin (DOGE/USDT)

The original meme coin, DOGE, continues to consolidate locally printing the BUEC (reaccumulation before continuing higher). In other words, it still looks good. The weekly chart shows the Stoch RSI indicator, at the bottom of the chart, curling up and crossing bullishly this week in oversold while RSI (the indicator above it) is hovering bullishly above neutral at this time. Wave ((iii)) has a minimum expected target of 0.35500. Congratulations to those who have continued to hold since I talked about DOGE being a good buy in June and August of last year. Price has rallied 300%, or so, since then depending on where you may have bought in.

Bonk (BONK/USDT)

I believe Bonk has a few possibilities at this juncture. Locally, wave iv may be complete, having pulled back around 50% of wave iii. Breaking out above the wave ((B)) extreme at 0.00003652 will add confidence to this scenario and give us an expected wave v target of 0.00005630 based on the height of wave iv. That could complete five waves up as a leading diagonal off the January 2024 swing low.

However, it also may just complete wave a of wave (v). In that scenario, we would look for a pullback toward the wave iv swing low before expecting to see a reversal and rally once more. That would need to break out above the swing high at that time and would give us a possible target of at least 0.00011175.

The daily Stoch RSI has reset into oversold and is starting to curl up while RSI remains bullish above neutral at this time.

Join me as I co-host spaces with Gary Cardone and Samuel Armes every Monday at 4 p.m. CST/5 p.m. EST. And, also, as I join Scott Melker every Wednesday at 8:30 a.m. CST/9:30 a.m. EST with some of the more interesting charts of the day.

My Schedule

Beards and Bitcoin simulcasting on Wednesdays

11:00 a.m CST

Market Analysis simulcasting on Fridays

11:00 a.m CST

Interviewing guests and discussing charts: