In the last issue of the Market Breakdown I ran a poll asking what you thought: was the FOMC going with a 50 or 75 bps rate hike in December. Eighty-one percent of the respondents said 50 bps and that is, in fact, what the FOMC did. So, here’s the thing, now that the FOMC has started to slow the rate hikes just how quickly will they get to a pause, or even a reversal?

The FOMC has eight regularly-scheduled meetings each year. Their 2023 schedule is as follows:

January 31-February 1

March 21-22

May 2-3

June 13-14

July 25-26

September 19-20

October 31-November 1

December 12-13

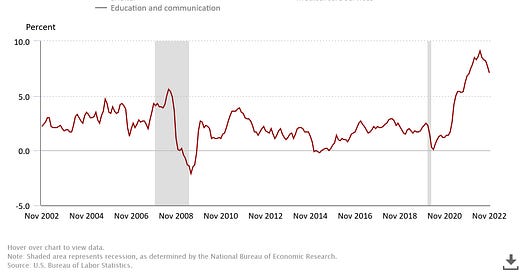

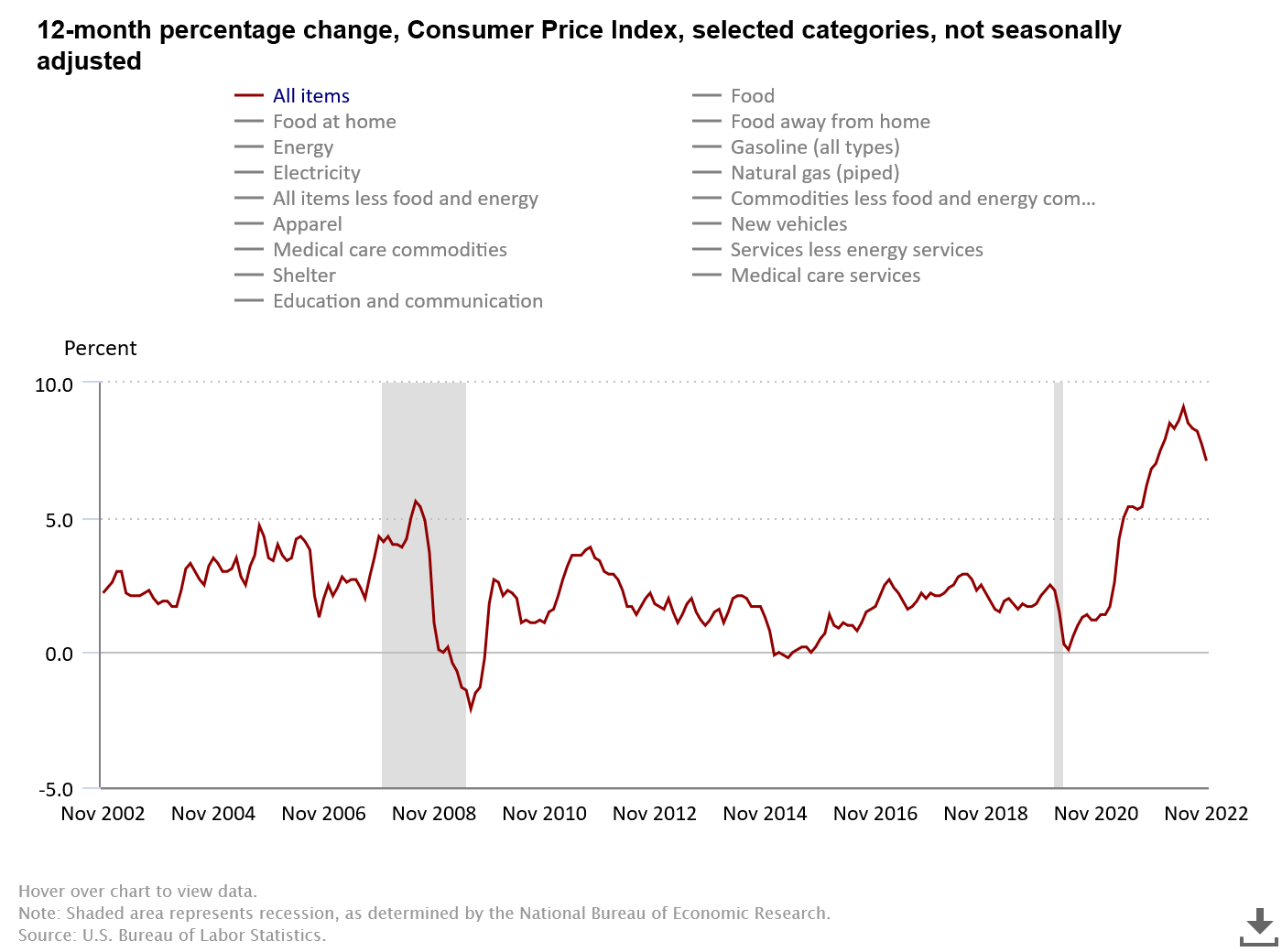

With inflation continuing to drop as it has, now sitting at 7.1% after peaking at 9.1% in June, there’s a good argument to be made for a 25 bps rate hike at the next meeting.

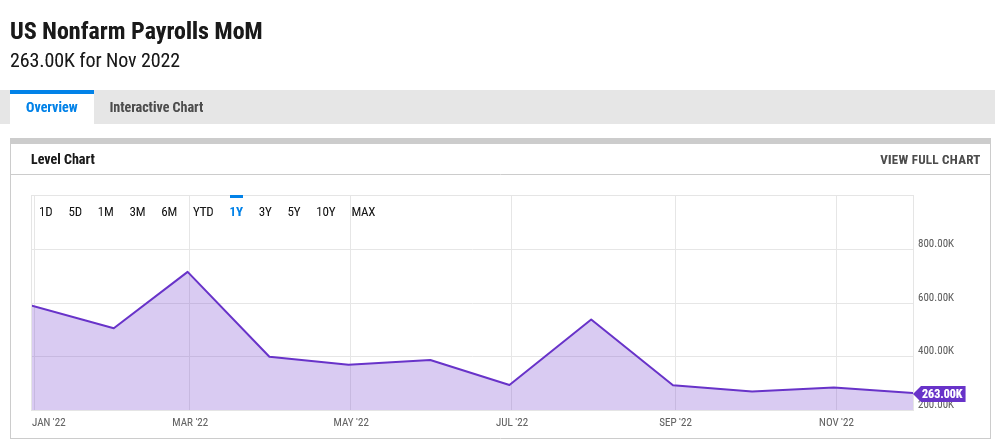

The odds become even more likely if we see it drop again in December. Additionally, a continued deceleration in job growth (Non-Farm Payrolls) will take pressure off the Fed as well. Like inflation, job growth has continued to decelerate this year from a high of 714K jobs added in February to the latest 263K jobs added in November.

As I have mentioned previously, your attention should be on the deceleration, not the pivot. Markets are forward looking, so deceleration in these two areas leads to a deceleration in the interest rate hikes. And markets will trade with the expectation of a coming pause, or even a pivot, as a result. So, if you wait for the pivot, then you will likely miss a lot of profits in the rally leading up to it.

But what about Japan?

In a sudden and unexpected move at its Monetary Policy Meeting on Monday, the Bank of Japan’s (BOJ) Policy Board said that it would allow the bond yield to move beyond the previously held 0.25% cap to 0.50%. The reason given in their statement was “to improve market functioning and encourage a smoother formation of the entire yield curve, while maintaining accommodative financial conditions.”

The BOJ has been using Yield Curve Control since 2016. But this yield change took the rest of the world by surprise because, until now, Japan has not followed in the steps of other countries which have raised their interest rates in an attempt to calm inflation this year. This move by the BOJ has led many analysts to believe that inflation will not be moving much lower anytime soon in the U.S. thereby giving the Fed no reason to pivot or even pause in 2023, with the reasoning that if the world’s most dovish central bank is now wavering then inflation must really be strong globally. And without the Fed pivot, the reasoning continues, stocks won’t be able to rally and, therefore, we will see them fall deeper into a vicious bear market. Are these analysts correct? Or are they blinded about the bigger picture because they are so sure that things will get worse next year rather than better? Nobody knows for sure, but we can continue to trade the daily market movements and make money regardless of which direction the markets move. Traders just need to focus on trading rather than looking for a short-term entry signal to give them a long-term target.

For a limited time

Join Tier 3 for only $75 for your first month - no autorenew!

Or 6 Months of Tier 3 for only $499! (save $701 over the month-to-month price)

Or 12 Months of Tier 3 for only $599! (save $1801 over the month-to-month price)

For those who are serious about doing everything they can to up their trading game, join the LMT Mentor Program. Our 1 year program will accelerate your knowledge of the market and trading, help you overcome psychological and emotional blocks that are keeping you from being successful, and so much more while learning my simple personal day trading system that keeps me profitable month-after-month regardless of whether the market is going up, down, or sideways! Having started the way everyone else in retail starts, making all the same mistakes, I eventually learned what works and what doesn’t. You don’t have to be the smartest person around; you just have to be humble enough to accept that you likely do not know what you think you do about the markets and trading, and then be open to listening and learning from someone who was once where you are right now. If you can do that, then I can help you become a consistently profitable trader and put you on the path to reaching your goals in 2023!

The US Dollar (DXY)

While the rate of decline has slowed, the DXY appears to have further downside still in store. Breaking down below the daily S1 pivot will usher in more decline. As such, I currently see little reason to believe we will witness any meaningful rally prior to the ~101/02 handle. We can note that the daily Stoch RSI is just now crossing bearishly after recently falling out of overbought and the daily RSI has flirted with oversold but has yet to actually reach it. Even when we do finally see a rally, however, I believe it will be corrective, likely targeting the 108 handle at most before being rejected and pushing below 101.

Bitcoin (BTC1!)

Looking at the Bitcoin CME Futures weekly chart, price appears to be printing a descending wedge. However, the closer price trends toward the apex of a perceived triangle or wedge, the more likely the pattern is to fail. We usually want to see price breakout of a pattern at around 66-75% of completion. So, the wedge is most likely not correct. Furthermore, I don’t like last week’s candle which is an inverse hammer, outlined in the yellow box. While this doesn’t guarantee that price will print new lows, it should have traders paying attention. A breakout above last week’s swing high, rather than a breakdown below the November swing low, will be significantly bullish due to that particular candle printing and being unable to result in follow-through below the swing low.

Tesla (TLSA)

Tesla has finally reached my initial target area at the blue structure’s equilibrium (EQ) around the ~136 handle. This target area finds confluence with the pitchfork’s lower blue support. Further decline gives us a target of the ~118 handle at the green structure’s EQ. We can note the extreme bearish sentiment throughout social media which often accompanies a low, so we will see if price can rally from one of these two areas. The weekly RSI has pushed into oversold and the Stoch RSI is oversold, which let’s us know that conditions are favorable to a reversal.

AUD/NZD

Taking a look at the monthly chart of the Aussie against the Kiwi, it looks like the Aussie could be headed for the 1.21253 level, followed by the 1.30252 level. This month’s candle is finding support at the range EQ and is printing what may complete as a bullish hammer with a long lower demand wick. It is possible that we could see some pullback into this month’s wick in January, which would likely reset the monthly Stoch RSI in oversold, but the structure of the range looks bullish and I would expect to see the AUD, ultimately, rally against the NZD in 2023.

The following is a guest article submitted by our friend and fellow veteran trader FiboSwanny:

Fibliminal Thinking

Create the charts you want by challenging your convictions

3 principles (based on charting/trading)

Accept our ignorance

There is one dominant aspect of wisdom - knowing what we don’t know. How often do we fall into the misapprehension of thinking we know a lot more than we really do? Despite me being in the world of market trading for years, I still see myself learning as if I have only just started.

Thinking we know more than we do can often make us close-minded, steadfast (and down right stubborn) in our doctrine of beliefs and makes us reluctant to absorb new information. In the long-run this stagnates our growth potential.

Ever consider acknowledging what we don’t know?

To me, this is powerful, and places us in a spot where life choices can be improved, which brings an honest overview of our potential, and even breaks down our thickness. When eyes are opened and our thick-headedness is penetrated where we can see that we really don’t know something, there are a plethora of things where many situations can be improved upon.

Knowing what you do not know…

… educates in areas of our lives to seek more information

… refers to someone else that can provide assistance

… makes us take a step back to allow us to make a less hasty decision.

When we grasp this concept, this puts us at a major advantage from others that are not aware of their own ignorance. We need to acknowledge our strengths and weaknesses, to seek out to test assumptions, however strong the truth seems. Challenge your beliefs to see if they are backed by some amount of evidence, logic, and/or personal experience…

One of the most important aspects to wisdom is knowing what we don't know. How often have you been in a situation where someone has claimed knowledge that turned out not to be true? In Fibonacci analysis for decades, I'm still constantly learning as if it were my first time seeing charts!

Sometimes our inability to accept reality can make us close-minded and stubborn. However, there is plenty of room at the table for new ideas which will help improve life choices over time - breaking down thick walls built up from ignorance.

“With my experience I have learned that I am ignorant.”

Final Thoughts

The FOMC came through and did what we have been expecting for December which was a 50 bps rate hike. This deceleration of hikes sets the stage for another possible deceleration into a 25 bps rate hike in February. But in order for that to happen we need to see continued deceleration of inflation and new jobs, at the least. Any surprises to the downside in CPI or the jobs report will make that decision to only hike rates by 25 bps in February that much easier for the Fed. If inflation has topped out as it appears to have done then, barring a rally into a double top, there is little keeping risk assets from rallying higher. And, yes, this includes cryptocurrencies. There is a lot of concern making its way through social media about Binance’s solvency. At the end of the day, the truth is that much of retail is out of the market at this point. So, the only ones to capitulate further are the larger professionals, but they tend to have much larger time frames which makes capitulation much less likely. As long as Binance can weather these questions about its solvency then we are likely to have seen the worst of the cryptocurrency bear market at this point. But we need to see Bitcoin rallying higher. It is the rising tide that lifts all ships. Retail won’t join in on a rally in any meaningful way, but that’s okay because all we need to see if that they don’t have the supply to hold back the rally.

My Streaming Schedule

I stream simultaneously on YouTube.com/texaswestcapital, Twitch.tv/texaswestcapital, and Twitter.com/txwestcapital on Tuesdays and Fridays at 11:00 a.m. CST. I’d love for you to stop in and share your thoughts about the charts. We usually look at everything from Bitcoin to stock indexes, Forex to precious metals, oil and gas to individual stocks and crypto pairs as well as the DXY. And of course I do my best to explain the macro events and what they likely mean, which is often much different than the usual large social media influencer accounts.