Be sure to catch the latest episode of the Friday Market Breakdown…

…and my weekly podcast Beards and Bitcoin airing on Wednesdays at 11 a.m. CST as Andrew and Tillman join me each week to discuss Bitcoin price, news, miners, and institutional insights.

Unveiling the Secrets of the Trading World: Insights, Strategies, and Scandals

Hey there, fellow traders! Welcome to another edition of our newsletter, where we dive deep into the world of trading and finance. Whether you're just starting out or you're a seasoned pro, we've got some killer insights and stories lined up for you. So grab a coffee, sit back, and let's get into it!

Editorial Commentary: The US NFP report was a banger last Friday cooling down market expectations of another 50 bps rate cut in November. Let’s take a look at the numbers.

New Bitcoin Documentary Sheds Light on Satoshi Nakamoto's Identity: Ever wondered who the mysterious Satoshi Nakamoto really is? This new documentary might just have some answers.

MicroStrategy's Next Big Move: MicroStrategy is on the hunt for a Bitcoin advocate. Could this be a game-changer for the company?

Billionaires Are Buying Bitcoin: When the big players start buying, you might want to pay attention. Should you follow their lead?

Crypto Ponzi Leader Sentenced: Justice is served as a crypto Ponzi scheme leader gets a hefty prison sentence. Find out what went down.

Bitwise ETF Rotation Strategy: Discover how Bitwise is shaking things up with their new ETF rotation strategy. Is this the future of trading?

Market Trends and Insights: Get the latest scoop on market trends and what they mean for your trading strategy.

Stay sharp, stay informed, and keep trading smart!

A Good September US Nonfarm Payrolls Report with Key Economic Implications

In all, the US economy created 254,000 jobs in September, well above economists' expectations of 140,000. That was the biggest gain since March and far above the prior three-month average of 140,000. The unemployment rate ticked down to 4.1%, underscoring the solidity of the labor market despite broader economic uncertainties.

The leisure and hospitality sector led the pack with 69,000 job gains for restaurants and bars. Next in line was the healthcare industry, adding another 45,000 jobs due to gains in home healthcare and hospital employment. Employment by government increased by 31,000 in July, paced by state and local hiring. Manufacturing employment declined 7,000 due to layoffs at motor vehicle manufacturers, while transportation and warehousing lost 8,600 jobs.

Wages continued to rise, with the average hourly earnings up 0.4% MoM and 4.0% YoY, reinforcing the strong demand for workers. Such wage growth, together with falling unemployment, raises the prospect of sustained inflationary pressures and possibly impacts the Federal Reserve's future decisions on interest rates.

That strength in the labor market underlines the resilience of the United States economy but also encumbers efforts by the Fed in its tightrope balancing act between cooling inflation and sustaining growth. With the surprise in the jobs, the markets had initially welcomed the news; now, the indications could be that unexpected strength in hiring may encourage the Fed to keep interest rates higher for longer than expected, therefore increasing uncertainty for investors and traders alike.

This report reminds one of the persisting tug-of-war between economic growth and the management of inflation and how each factor influences the markets and monetary policies.

MicroStrategy's Bold Move: Hunting for a Bitcoin Advocate

MicroStrategy is making waves again, and this time they're on the lookout for a Bitcoin advocate. Yep, you heard it right! They're searching for someone who can champion Bitcoin and help steer the company's crypto strategy. It's like they're assembling a dream team for the digital age!

MicroStrategy has been a big player in the Bitcoin space, with their CEO, Michael Saylor, being a vocal supporter. Now, they're doubling down on their commitment by bringing in fresh talent to push their Bitcoin agenda even further. This move shows their dedication to staying at the forefront of the crypto revolution.

Why should you care? Well, this could mean more innovation and growth in the Bitcoin ecosystem. Plus, it highlights how major companies are taking crypto seriously. If you're curious about what this means for the future of Bitcoin and business, you won't want to miss this story.

Check out the full article here.

Billionaires Are Buying Bitcoin: Should You Jump In?

It seems like the big guns are at it again. Billionaires are snapping up Bitcoin, and it's got everyone talking. When the wealthiest folks start making moves, you can't help but wonder if you should follow suit. Is it time to dive into the crypto pool?

These financial titans are known for their savvy investments, and their interest in Bitcoin is no exception. They're betting big on the future of digital currency, and that might just be a sign of things to come. But, as always, there's a catch—investing in Bitcoin isn't for the faint-hearted.

So, what's the deal? Should you join the billionaire bandwagon or sit this one out? This article breaks down the pros and cons, helping you decide if Bitcoin is the right move for your portfolio. If you're itching to know more about this trend and what it means for everyday investors, this is a must-read!

Get the full scoop here.

Crypto Ponzi Scheme Leader Gets 121-Month Sentence

Here's a story that'll make you nod in approval. A crypto Ponzi scheme leader has been slapped with a 121-month prison sentence. Yep, the law finally caught up with this mastermind, and it's a big win for those who fell victim to his shady dealings.

This case is a stark reminder of the risks lurking in the crypto world. While digital currencies offer exciting opportunities, they also attract some bad apples. This sentencing sends a clear message: fraudsters won't get away with their tricks forever.

So, what went down? This article dives into the details of the scheme and how the justice system brought the leader to book. It's a cautionary tale for anyone dabbling in crypto, highlighting the importance of staying vigilant and informed. If you're keen to learn more about this case and its implications, don't miss out!

Read the full story here.

Bitwise's New ETF Rotation Strategy: A Game Changer?

Bitwise is shaking things up with their latest ETF rotation strategy. This new approach could be a game changer for those looking to diversify their portfolios. It's all about staying ahead of the curve and maximizing returns.

Bitwise is known for its innovative take on crypto investments, and this strategy is no different. By rotating ETFs, they're aiming to capture the best opportunities in the market. It's like having a dynamic playbook that adapts to the ever-changing financial landscape.

Why should you care? Well, this could mean more efficient ways to grow your investments without the usual headaches. If you're curious about how this strategy works and what it could mean for your financial future, this article is a must-read. Dive in to see if Bitwise's approach aligns with your investment goals.

Check out the full article here.

TWC Traders Club - ONLY $50/month!

Get access to the exact cryptocurrency and futures trades me, Brian “FiboSwanny” Swan, and Andrew Bennett are taking throughout the week. Also get access to my R.I.S.K. framework workshop recording, daily market analysis, live event access to discussions of trader and market psychology, and more! Check out TWC Traders Club for more info and then join us! If you already have an account on our platform please use this link instead of the one on the website.

Stock Indexes

We got a bit further pullback across all three indexes. This confirmed that the local top was in. However, the pullback was not very strong through the week In fact, the Nasdaq found its low on Tuesday, the SPY on Wednesday, and the Dow on Thursday. Importantly, all three indexes had a really good Friday. So, overall, it looks like we should see all three continue to break higher this week.

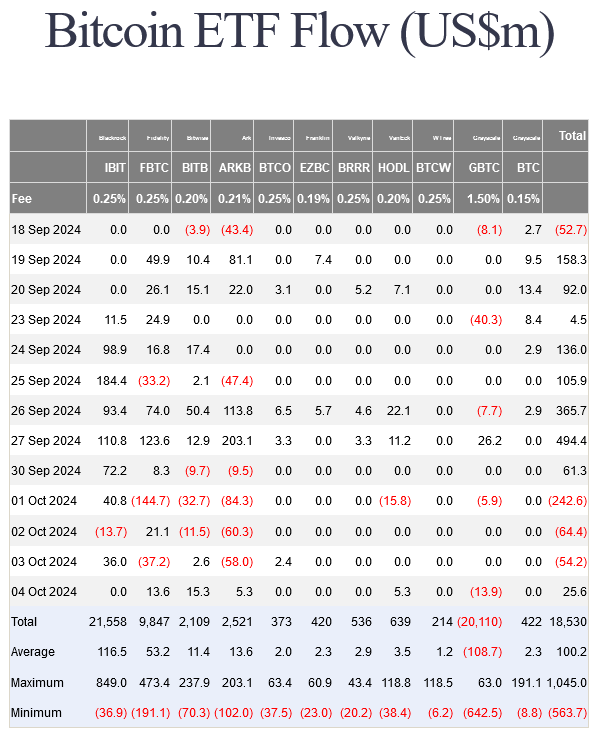

Bitcoin ETF Flows

The Bitcoin ETFs had a down week, last week, with October 1st being the worst day. We saw a net outflow of $274.3M for the week. That was about a quarter of the previous week’s net inflow. So, overall, the Bitcoin ETFs as a whole continue to look good even with last week’s results.

Bitcoin

We got the break out above the previously-labeled wave (i) extreme before pulling back to the new month’s daily blue pivot area and printing hidden bullish divergence. I have adjusted the count to suggest that we are likely seeing a wave (i) leading diagonal with an initial target of the daily R1 pivot at ~61147.

After a couple of days hanging around the daily pivot, price took off and has rallied almost 7% off the pullback’s swing low. The expectation is to see price rally into the R1 pivot area and then pull back into the blue daily pivot. From there we should then expect to see the rally that breaks out into a new ATH. However, I think the earliest that we would likely see that new ATH would be toward the end of October.

As mentioned previously, price broke out above the wave ((B)) extreme at 61202 on the Bitcoin All Time Index chart which signals that wave ii is likely complete and that wave iii is in progress toward a minimum expected target of 82478. The larger degree wave ((v)) has a target of 93654 based on the height of wave ((iv)).

If this cycle is to end like every cycle before, then we should expect wave ((v)) to overextend much higher. Based on previous cycles, we should also not expect it to end until Q4 of 2025. However, there’s a lot of things that need to happen in the meantime to make that a reality so we will continue to trade the chart as it prints rather than tell it what it needs to do.

You can subscribe to the weekly Bitcoin Miner Stocks Report newsletter where you will get the week’s information and news regarding this sector, commentary, and most importantly updated charts of 15+ public bitcoin mining companies. Subscribers have been able to jump in on some big moves as they were well-positioned before the stocks popped. And as of late they’ve been able to wait for their entry as the miners have corrected more recently. The next issue will go out Monday evening.

*If you are one of the few TWC lifetime members, this subscription is included in your membership. So, send me a quick DM to make sure I get you subscribed.

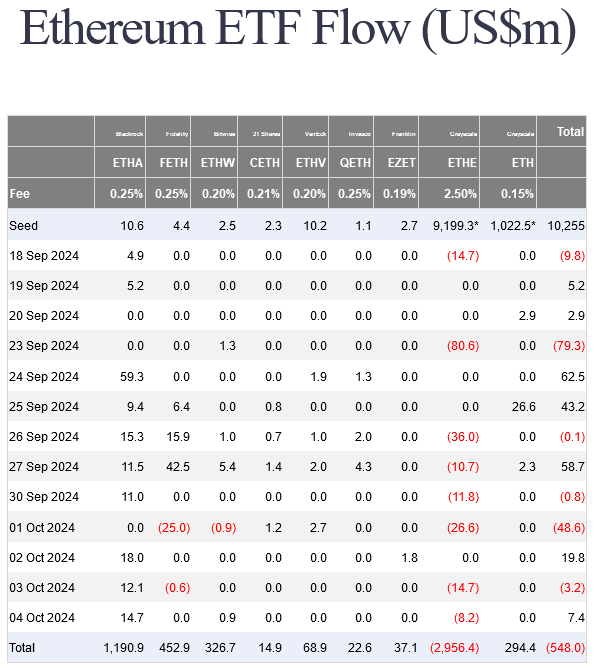

Ethereum ETF Flows

The Ethereum ETFs had a down week as well. The ETFs had a net outflow of 25.4M. While that is significantly less than the Bitcoin ETFs’ net outflow we have to remember that these Ethereum ETFs have significantly less interest overall as well.

Ethereum

Price pulled back a bit further than initially expected but has been rallying since last Thursday. It is currently attempting to break out through the new month’s blue daily pivot sitting at 2493.55 on this chart. Last week’s pullback ultimately found support on the local range’s EQ denoted by the horizontal dashed line.

There is no change with the bigger picture as it continues to look like price is printing a diagonal with wave ((iii)) terminating at the cycle high of 4093.88 and wave ((iv)) possibly being complete at 2116.02. Breaking down below that low will keep wave ((iv)) alive with an initial target of the weekly pivot at 1970 or secondary target of 1787.

Wave ((v)) has an expected target of 6160 based on the current height of wave ((iv)).

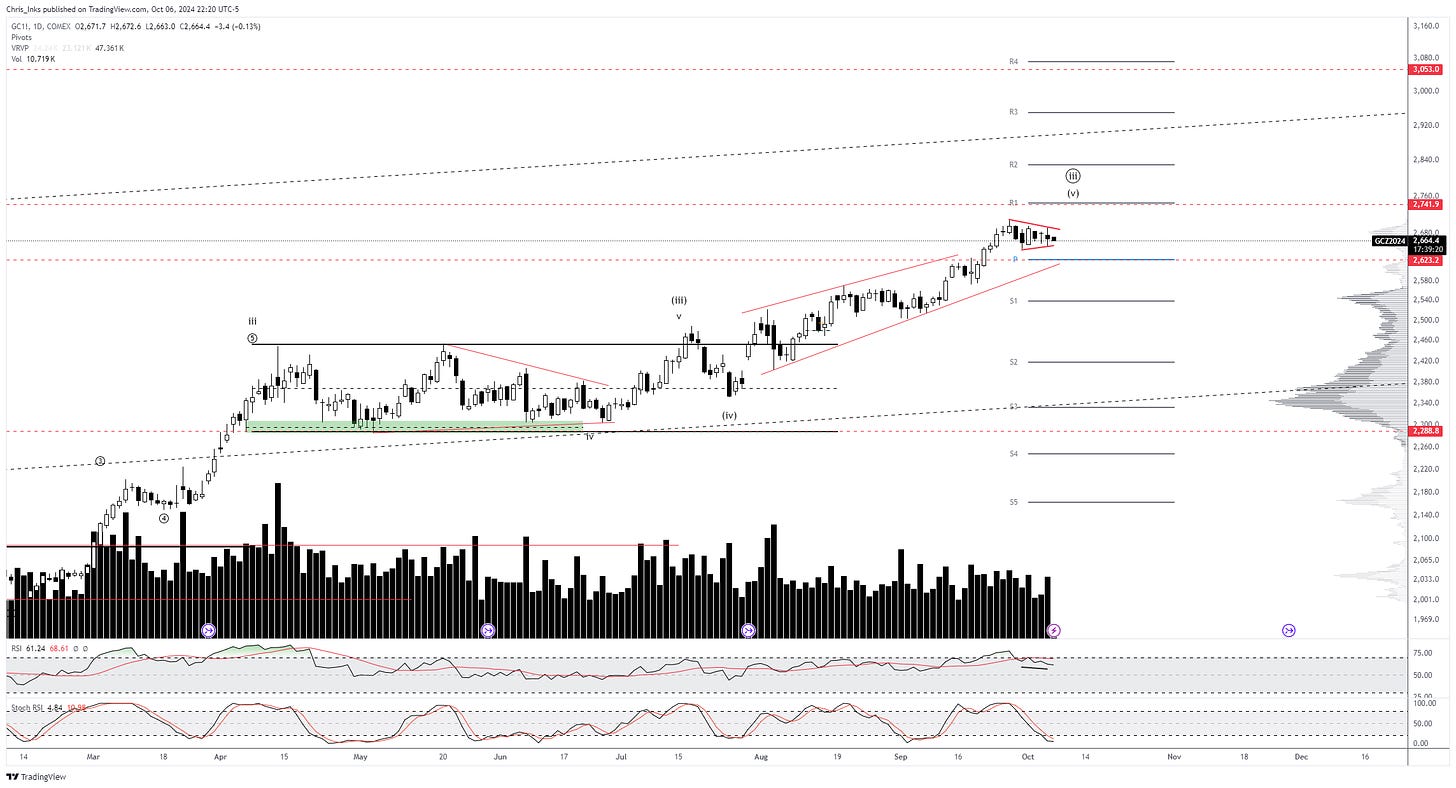

Gold Futures (GC1!)

Price is keeping the possible triangle alive so far. Breaking down and closing below the ascending red support will single that wave ((iii)) is likely complete. However, I am watching for one more push higher to reach the target area of ~2741.90 around the R1 pivot.

The US Dollar Index (DXY)

The DXY did end up giving us an impulsive rally from just above the S1 pivot area. Further rally has a target of ~103.122. A rejection between the current level and that target area should have us watching for the DXY to target the 98.39-98.64 range.

Emotional control is the most essential factor in playing the market. Don’t anticipate! Wait until the market gives you the clues, the signals, the hints, before you move. Move only after you have confirmation. Anticipation is the killer. It is the brother to greed and hope. Don’t make decisions based on anticipation. The market always gives you time. If you wait for the clues there will be plenty of time to execute your moves.

— Jesse Livermore

Chart of the Week

The IOTX/USD chart looks good to go at this time. Breaking out and closing above the blue daily pivot at 0.04027 should give us an expected ~41% run into the blue supply structure EQ area around the R2 pivot of 0.05647.

Price is currently rallying off the wave ((4)) extreme which printed hidden bullish RSI divergence. We appear to have a leading diagonal in progress off the August 5th swing low, hence the overlapping price action.

TWC Trading Academy Group Coaching

Tired of not knowing what you’re doing in the markets? Do you want to finally understand how and why markets move like they do? Not only that, but what if you could also learn how to trade them profitably? We teach day trading for income and price forecasting for wealth building in the markets.

Join the TWC Trading Academy today and stop throwing away money!

*Includes access to TWC Traders Club

Join me as I co-host spaces with Gary Cardone and Samuel Armes every Monday at 4 p.m. CST/5 p.m. EST. And, also, as I join Scott Melker every Wednesday at 8:30 a.m. CST/9:30 a.m. EST with some of the more interesting charts of the day.

My Schedule

Beards and Bitcoin simulcasting on Wednesdays

11:00 a.m CST

Market Analysis simulcasting on Fridays

11:00 a.m CST

DISCLAIMER: This newsletter is intended solely for educational purposes and should not be construed as financial advice. It does not constitute an investment recommendation or a solicitation to buy or sell any assets. Please exercise due diligence and conduct your own research before making any financial decisions.

The Market Breakdown newsletter does not operate as a registered investment advisor. This document is provided purely for informational purposes and does not constitute an offer or invitation to buy or sell any financial instruments. The viewpoints expressed are derived from historical data analysis and are deemed reliable, though their accuracy is not assured. Readers are entirely accountable for any decisions made based on this information.

CFTC RULE 4.41 - These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.