Be sure to catch the latest episode of the Friday Market Breakdown…

…and my weekly podcast Beards and Bitcoin airing on Wednesdays at 11 a.m. CST as Andrew and Tillman join me each week to discuss Bitcoin price, news, miners, and institutional insights.

Risk on and risk off assets rallied in September

Hey there, fellow traders! Welcome to this week’s edition of the newsletter, where we dive deep into the financial markets to bring you the latest insights and strategies. Whether you're just starting out or you're a seasoned pro, we've got something for everyone. Let's get into it!

Binance's CZ Zhao: A Free Man: Get the scoop on Binance founder Changpeng Zhao's recent legal triumph and what it means for the crypto world.

Swan Bitcoin Sues Employees Over Tether Mining Theft: Dive into the drama as Swan Bitcoin takes legal action against former employees in a case that’s shaking up the crypto world.

Bitcoin ETF Inflows Surge 5%: Bitcoin's making waves again with a significant uptick in ETF inflows. What does this mean for the market?

Gold Hits Record High as U.S. Interest Rates Slide: Gold is glittering like never before. Discover the factors driving this precious metal to new heights.

Spot Silver Soars to 12-Year High: Silver's on a tear, outpacing even gold's rally. What’s fueling this surge?

China's Market Moves and Global Impact: China's latest economic maneuvers are making waves. How will this affect global markets?

Stay sharp, stay informed, and keep trading smart!

Binance's CZ Zhao: Free and Ready to Shake Up Crypto

Big news in the crypto world: Binance founder Changpeng "CZ" Zhao is a free man. After a whirlwind of legal drama, CZ is back in action, and the crypto community is buzzing with excitement.

His freedom marks a pivotal moment for Binance, one of the largest crypto exchanges globally. With CZ at the helm, Binance is poised to continue its innovative streak, potentially reshaping the crypto landscape.

For traders and investors, this could mean new opportunities and developments in the crypto space. CZ's return might just be the catalyst for fresh strategies and market moves.

So, if you're into crypto, keep an eye on Binance and CZ's next steps. This is a story you don't want to miss. For the full scoop, check out the article on CoinDesk.

Crypto Drama: Swan Bitcoin's Legal Showdown

Swan Bitcoin is taking some serious action, suing former employees over a Tether mining theft that’s got everyone talking. This case is a big deal, and it’s shaking up the industry. If you’re into crypto, you’ll want to keep an eye on this one.

So, what’s the scoop? Allegedly, these ex-employees were involved in some shady business, and Swan Bitcoin isn’t having it. They’re going all out to protect their assets and reputation. This legal battle could set a precedent for how companies handle internal theft in the crypto space. It’s a wild ride, and it’s just getting started.

For those of you who love a good courtroom drama, this is like the crypto version of a blockbuster movie. The stakes are high, and the outcome could have ripple effects across the market. Stay tuned, because this story is far from over. Read the full article here.

Bitcoin ETF Boom: Inflows Surge 5%

Bitcoin ETFs are seeing a massive surge, with inflows jumping by 5%. This is big news for crypto enthusiasts and investors alike. It shows that confidence in Bitcoin is on the rise, and people are putting their money where their mouth is.

Why's this happening now? Well, it seems like more investors are looking for ways to get in on the Bitcoin action without directly buying the cryptocurrency. ETFs offer a safer, more regulated way to do just that. This surge could be a sign of even bigger things to come in the crypto market.

For those of you keeping score, this is a major milestone. It’s like the crypto world is getting a big thumbs up from traditional investors. Read the full article here.

Gold Rush: Record Highs Amid Sliding U.S. Rates

Gold is shining brighter than ever, hitting a record high as U.S. interest rates take a dive. This precious metal is on a roll, and investors are flocking to it like bees to honey. It’s a classic move when the economy gets a bit shaky.

So, why's gold on the rise? With U.S. interest rates sliding, folks are looking for safe havens to park their money. Gold has always been a go-to in uncertain times, and right now, it’s proving its worth once again. This trend might just keep going if rates stay low.

For those of you keeping an eye on the markets, this is a big deal. It’s like a signal that investors are hedging their bets. Read the full article here.

Silver's Shining Moment: Soaring to 12-Year High

Spot silver has soared to a 12-year high, even outpacing gold's impressive rally. This precious metal is on a tear, and investors are taking notice. It’s like silver’s having its moment in the sun.

Why's silver on such a roll? With economic uncertainties and inflation fears, folks are turning to silver as a safe bet. It’s not just about jewelry anymore; silver's becoming a key player in the investment world. This surge could mean big things for those holding onto silver.

For anyone tracking the markets, this is a game-changer. Silver's rise is a clear sign that investors are diversifying their portfolios. Read the full article here.

Market Moves: Dow Futures, China Stimulus, and Tesla's Next Big Step

There's a lot happening in the financial world right now, and it's time to get the lowdown. The Dow Jones futures are making waves, and China's latest stimulus efforts are adding fuel to the fire.

But wait, there's more! Tesla's got some exciting news with a new buy point and delivery updates that could shake things up. For traders, this is a golden opportunity to reassess strategies and make informed decisions.

With these developments, the market is buzzing with potential. Whether you're into stocks or just curious about the latest trends, this is a must-read.

Stay ahead of the game and dive into the full article on Investor's Business Daily.

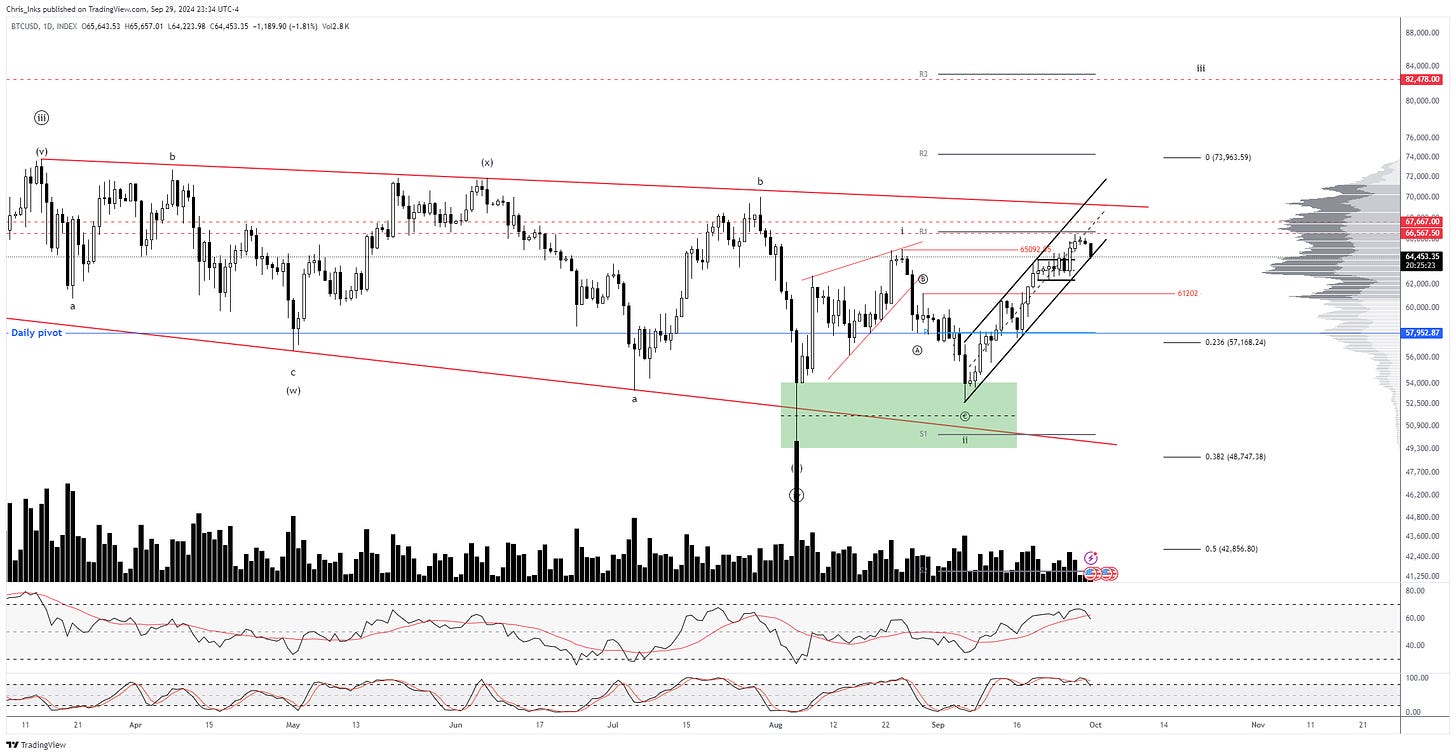

TWC Traders Club - ONLY $50/month!

Get access to the exact cryptocurrency and futures trades me, Brian “FiboSwanny” Swan, and Andrew Bennett are taking throughout the week. Also get access to my R.I.S.K. framework workshop recording, daily market analysis, live event access to discussions of trader and market psychology, and more! Check out TWC Traders Club for more info and then join us! If you already have an account on our platform please use this link instead of the one on the website.

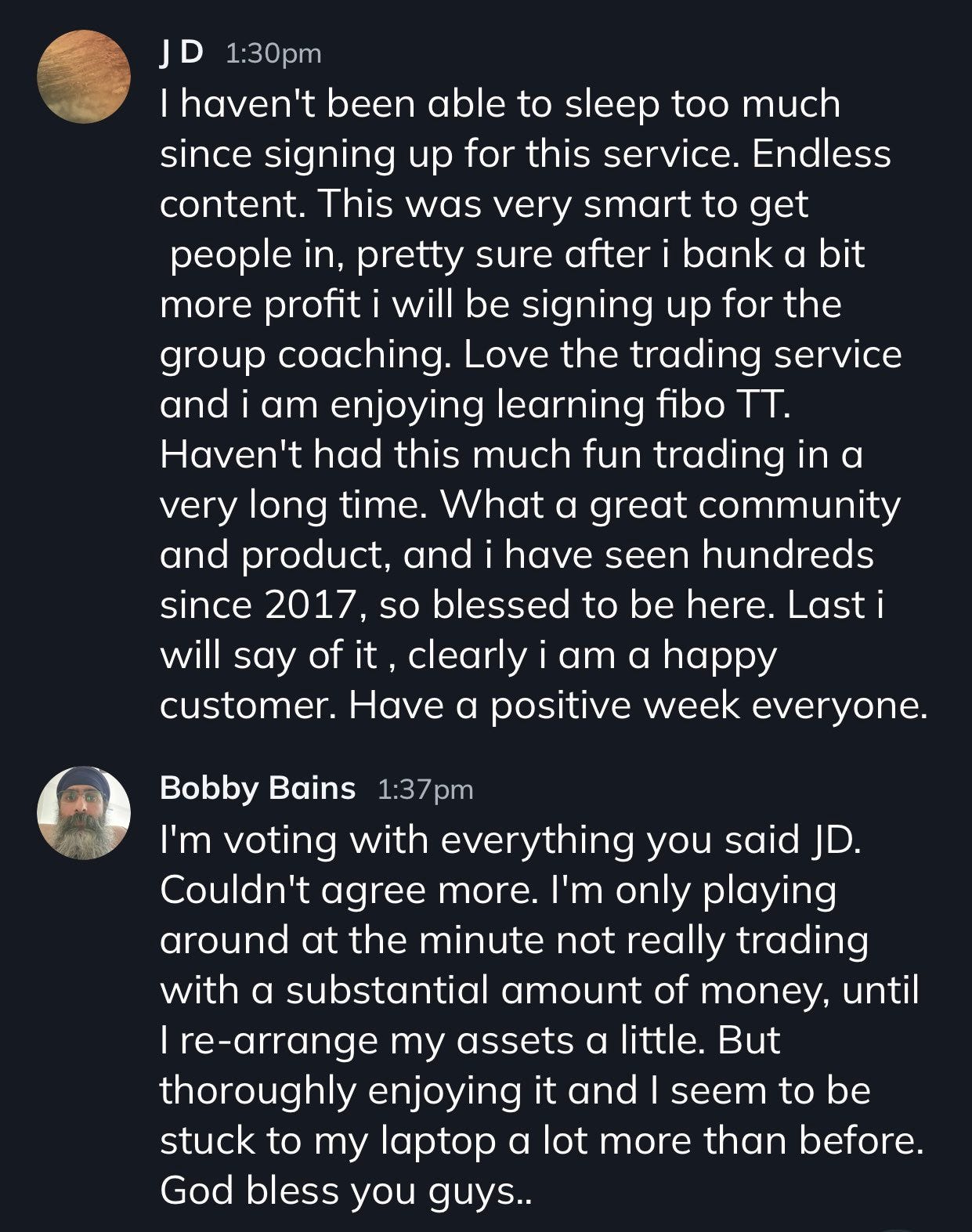

Stock Indexes

The stock indexes did in fact follow through higher last week as mentioned was likely in last week’s newsletter. But only the Dow made a new high on Friday, reaching the R1 pivot on the daily time frame before being rejected. The Nasdaq and SPY had down days on Friday, but both managed to stay above Thursday’s lows. Continued close lower on Monday will suggest a local top is in.

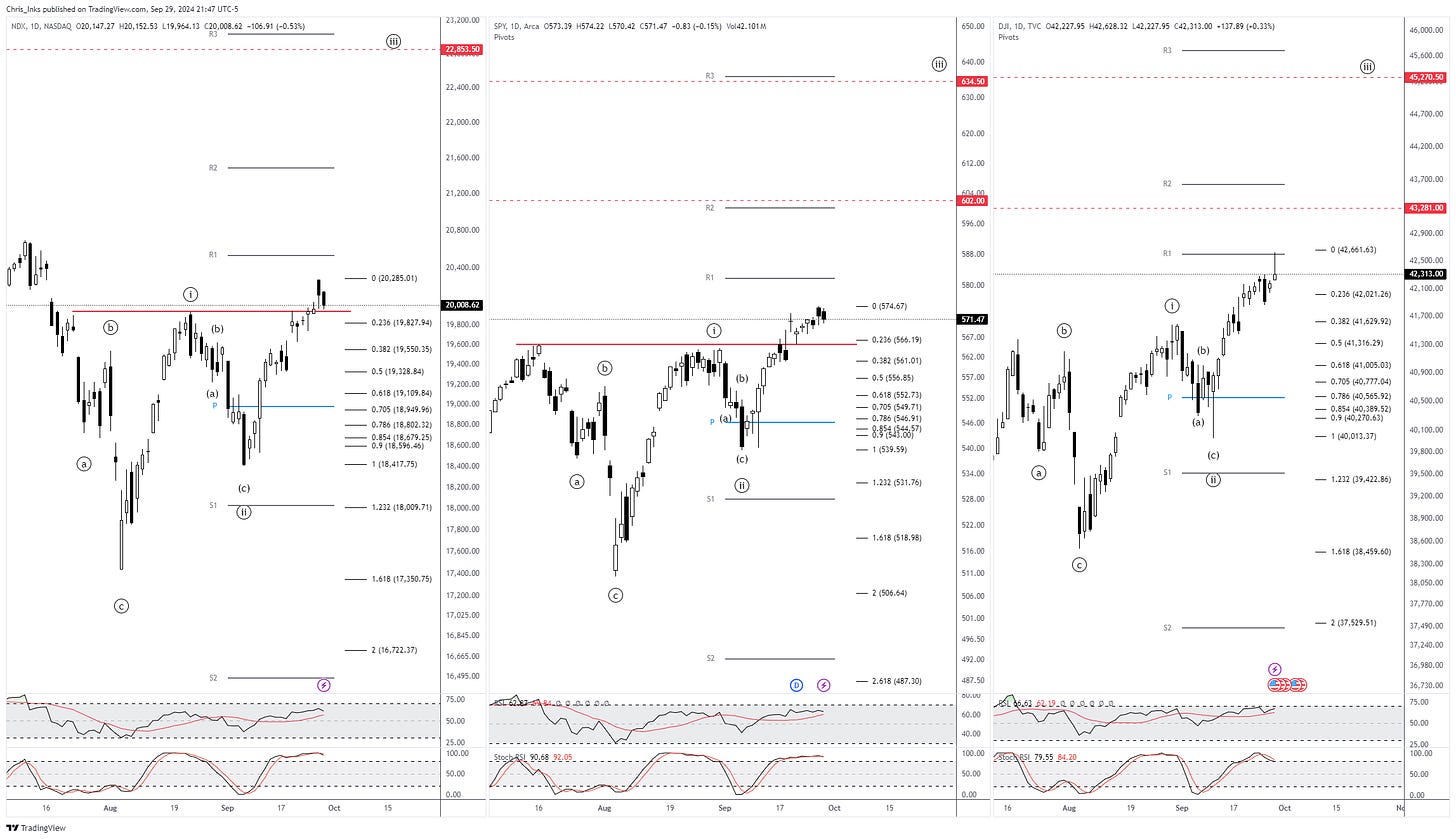

Bitcoin ETF Flows

The Bitcoin ETFs continued to see buyers stocking up. We saw a positive net inflow of $1106.5M for the week. Specifically, we saw Friday rake in almost half of that with a $494.4M haul.

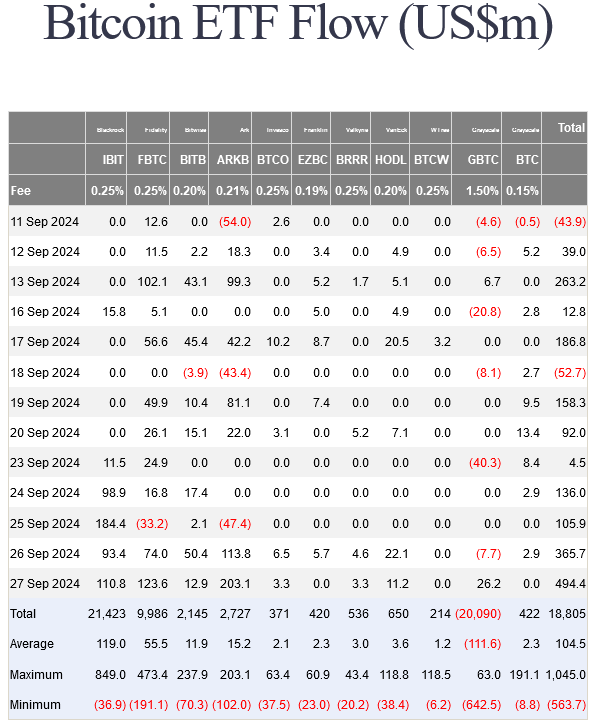

Bitcoin

Price rallied another ~7.75% this past week. In doing so it has nearly broken out above the wave i extreme.

We are seeing price pull back today into the ascending channel support. A daily close below that support will warn that a local top may be in and would give us an initial target of previous resistance at the 61202 area. We can note a low volume node (LVN) just above that area on the right side of the chart.

As mentioned previously, price broke out above the wave ((B)) extreme at 61202 on the Bitcoin All Time Index chart which signals that wave ii is likely complete and that wave iii is in progress toward a minimum expected target of 82478. The larger degree wave ((v)) has a target of 93654 based on the height of wave ((iv)).

If this cycle is to end like every cycle before, then we should expect wave ((v)) to overextend much higher. Based on previous cycles, we should also not expect it to end until Q4 of 2025. However, there’s a lot of things that need to happen in the meantime to make that a reality so we will continue to trade the chart as it prints rather than tell it what it needs to do.

You can subscribe to the weekly Bitcoin Miner Stocks Report newsletter where you will get the week’s information and news regarding this sector, commentary, and most importantly updated charts of 15+ public bitcoin mining companies. Subscribers have been able to jump in on some big moves as they were well-positioned before the stocks popped. And as of late they’ve been able to wait for their entry as the miners have corrected more recently. The next issue will go out Monday evening.

*If you are one of the few TWC lifetime members, this subscription is included in your membership. So, send me a quick DM to make sure I get you subscribed.

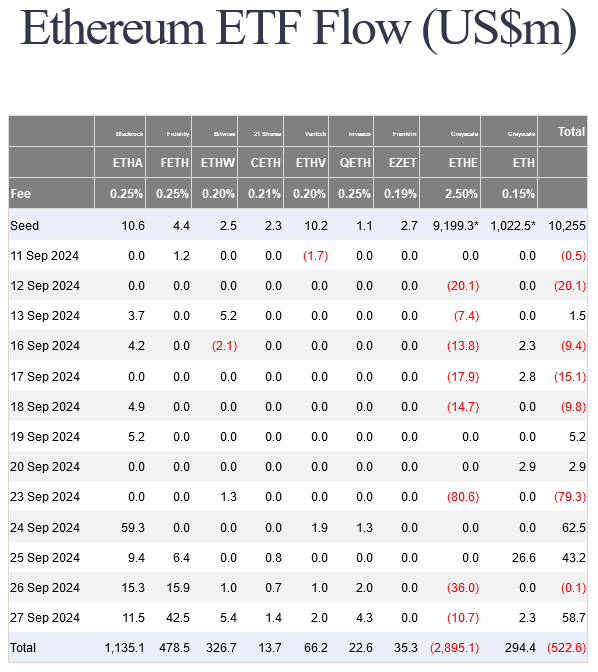

Ethereum ETF Flows

The Ethereum ETFs notched a positive inflow week with $85M. The overall interest in the Ethereum ETFs continues to be significantly less than that of the Bitcoin ETFs. Grayscale’s ETHE product had 2 days of of no flows and 3 days of outflows keeping the negative pressure on the overall ETF flows.

Ethereum

After rallying for the past few weeks we are seeing a local pullback at the start of this week. However, it looks like the previous week’s swing high is only a local top and price should continue to break out higher after pulling back a bit further.

There is no change with the bigger picture as it continues to look like price is printing a diagonal with wave ((iii)) terminating at the cycle high of 4093.88 and wave ((iv)) possibly being complete at 2116.02. Breaking down below that low will keep wave ((iv)) alive with an initial target of the weekly pivot at 1970 or secondary target of 1787.

Wave ((v)) has an expected target of 6160 based on the current height of wave ((iv)).

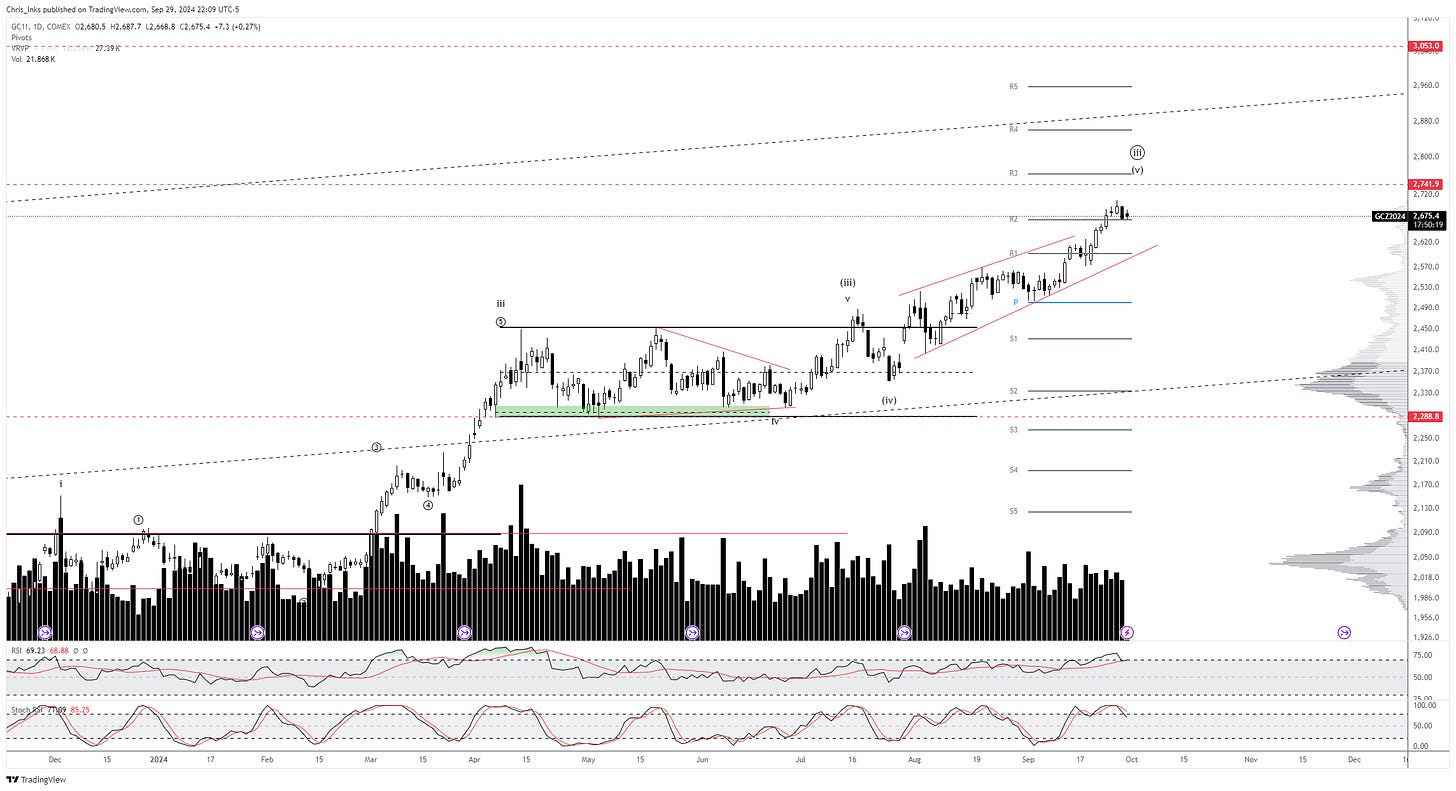

Gold Futures (GC1!)

Price pulled back last week which may be a warning that wave ((iii)) is complete just around $34 shy of the target. Breaking down and closing below the ascending red support will add confidence to that narrative. However, I am watching for one more push higher to reach the target.

The US Dollar Index (DXY)

The DXY continues to fight to hold support locally but still looks heavy sitting at that support. I still don’t believe we should expect that support to continue to hold. Instead, we should be focused on the target of the next swing low at 99.589.

Few people ever make money on tips. Beware of insider information. If there was easy money lying around, no one would be forcing it into your pocket.

— Jesse Livermore

Chart of the Week

The DESO/USD chart looks like it may be ready to rally. Breaking out above 8.72 will give us an initial target of the S1 pivot around 14.85..

We can see a large capitulation in the last week of July. This has been followed by overlapping candles taking price into the demand structure created by the ATL in 2022. Locally, we’ve got multiple weeks of smaller and smaller dojis printing. We should also not the very small candle spread directly after the capitulation candle because while volume was half the capitulation candle’s volume, that second candle spread was only 1/8th the size of the capitulation candle’s spread. This is significantly more effort in regards to the effort by supply which is why we saw price only dip slightly lower and after bouncing is consolidating.

TWC Trading Academy Group Coaching

Tired of not knowing what you’re doing in the markets? Do you want to finally understand how and why markets move like they do? Not only that, but what if you could also learn how to trade them profitably? We teach day trading for income and price forecasting for wealth building in the markets.

Join the TWC Trading Academy today and stop throwing away money!

*Includes access to TWC Traders Club

Join me as I co-host spaces with Gary Cardone and Samuel Armes every Monday at 4 p.m. CST/5 p.m. EST. And, also, as I join Scott Melker every Wednesday at 8:30 a.m. CST/9:30 a.m. EST with some of the more interesting charts of the day.

My Schedule

Beards and Bitcoin simulcasting on Wednesdays

11:00 a.m CST

Market Analysis simulcasting on Fridays

11:00 a.m CST

DISCLAIMER: This newsletter is intended solely for educational purposes and should not be construed as financial advice. It does not constitute an investment recommendation or a solicitation to buy or sell any assets. Please exercise due diligence and conduct your own research before making any financial decisions.

The Market Breakdown newsletter does not operate as a registered investment advisor. This document is provided purely for informational purposes and does not constitute an offer or invitation to buy or sell any financial instruments. The viewpoints expressed are derived from historical data analysis and are deemed reliable, though their accuracy is not assured. Readers are entirely accountable for any decisions made based on this information.

CFTC RULE 4.41 - These results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.